![]()

Masterclass

Raise Your Fund Bigger, Faster, Easier

How many managers want to raise their fund smaller, slower, harder? This program is for those of you who want bigger, faster, easier!

When you want to go bigger in less time.

You can run around for years flipping decks or get yourself a winning method.

A first time private equity fund came to us…

Afraid they’d fail in the capital raise.

Now, to be fair, these guys had a lot going for them.

They are highly credible investors.

Nearly twenty years experience investing at a top private equity shop.

With a great track record and story for starting their own firm.

Without this method for Raising Your Fund Bigger, Faster, Easier they still would have gotten the fund raised.

But it’s a highly competitive market for capital, and always hard to raise a first time fund.

Their cap intro partner and others told them it would be tough.

They hoped to do better but had somewhat resigned themselves to raising $200-$300 million over the average 16 month raise.

7 months later they closed on $600+ million.

An impressive first time fund raise!

Many people in the market might say they killed it.

And they did.

Not just on the result, which, frankly, is secondary to us.

They killed it because they did the work you’re learning in this program, to show up best prepared.

To walk into the room and kill it every time.

Now, I’m not saying this method is why they absolutely crushed the capital raise.

Lots of things must go right for you in winning this game.

Just saying that when you come at it like a pro, you’re more likely to win.

It’s not called smaller, faster, harder!

This Masterclass is called Raise Your Fund Bigger, Faster, Easier…

Because in every way this is what it’s built to do.

In the end it’s built for you to drive mind-blowing results.

To raise more capital. Faster. Easier.

But also this method is built for you to learn faster and easier.

Our clients are busy people.

By the time we get involved, typically the train has left the station, and they’re already lining up investor meetings.

So we must have impact, fast.

When you’re starting your own firm or even just raising a fund, you have so many things going on.

That you want a powerful method that’s easy for you to learn fast and put to work for driving top results.

Who wants to settle for smaller, slower, harder?

Get less capital than you need for your business.

Who wants that? To be stuck, committed to a smaller fund than you need?Slower, anyone?

More time running around having meetings? More time away from your family? From investing?What about harder?

Who wants harder when you can go bigger, faster, easier?

Then master the “sale!”

One thing we cover in this program is that many managers fail at the capital raise because…

They fail to recognize that capital raising is selling.

In fact, the bigger idea that many managers fail at is…

Now seeing their job is selling.

Many hate this idea…

They’re investors, not damn promoters!

Not any more…

When you had a job you could get away with just being an investor, but as a founder of an asset management business, investing is only one part of the game.

Top investors start their own firm because they love to invest only to realize that investing is now the last part of winning.

Putting up top results isn’t enough.

Hiring a top team isn’t either. They’re part of the game, but capital is the entire game.

No capital. No game.

Yet, ironically, for people who spend their lives mastering other business models, few investors have mastered their own.

This I refer to as the MASSIVE HIDDEN problem for investors.

The MASSIVE HIDDEN problem…

Many first time managers miss this, making the mistake of thinking their job is still investing.

In the past they had a job of being an investor, but now they are an entrepreneur, a founder of a startup whose business is acquiring and managing assets.

Right, so the job is investing.

But the business is acquiring assets to invest.

They might sound similar but of course they are very different jobs that demand very different processes and skills.

This is where even many top investors fail at starting, and keeping their firm alive.

A great tragedy of the investment business is…

Some of the best investors are some of the worst capital raisers.

We meet them all the time and you surely know plenty too.

They’ve spent perhaps decades mastering the craft of investing.

But they’re novices at capital raising and quickly need to learn the processes and skills to win.

Very different processes and skills.

Winning an election takes very different processes and skills to governing, and investing capital takes very different processes and skills to raising it.

In the arena of investing managers have deep expertise and the muscle memory that gives them edge.

Yet few step into the arena of capital raising this way.

Sure, they’ve read plenty of decks in the past. Sat in fund raising meetings on their old platform.

But now, with no big brand supporting the sale. No fundraising team. No founder whose job it is to get the capital raised.

Now it’s all on you, and many lack the processes and skills they need.

By the time many managers realize this, there is simply too much that they can’t learn fast enough.

Which is why this method isn’t about quickly learning the craft of selling…

You don’t have years to master it like a game of golf, and instead need a method that you can learn and put to work fast.

This demands a sophisticated, yet simple, repeatable method that anyone can put to work right away.

Another client is at $5 billion.

They too went to market to raise their first fund expecting a lesser result.

Less capital.

More time on the road.

But having stepped back and done the work they annihilated the capital raise.

To be completely honest, the fund raise took them longer, a couple of years.

But they came out with close to a billion dollars, and quickly moved beyond.

And only a few years later we are in market raising their next fund!

These guys absolutely killed the capital raise.

And once again there’s lots of reasons for this.

But one reason is just like the way they invest, they became highly skilled at what it takes to win the capital raising game.

For managers looking to crush it!

This program is for any manager looking to absolutely crush the capital raise.

But it’s particularly valuable for managers who are doing the hardest capital raise, your first fund in PE or VC, or a HF manager raising initial capital.

You’re starting from scratch.

You’ve never done this before.

We all know this is the hardest part to starting your business, and getting this right is life or death to your firm.

And even though it might seem like there’s a lot to learn.

As I keep saying this method is built for you to learn and put to work fast in crushing your capital raise.

An end-to-end, highly systematic method.

This program isn’t just some random ideas on capital raising.

Or your pitch deck.

Or some “salesy” sounding ideas.

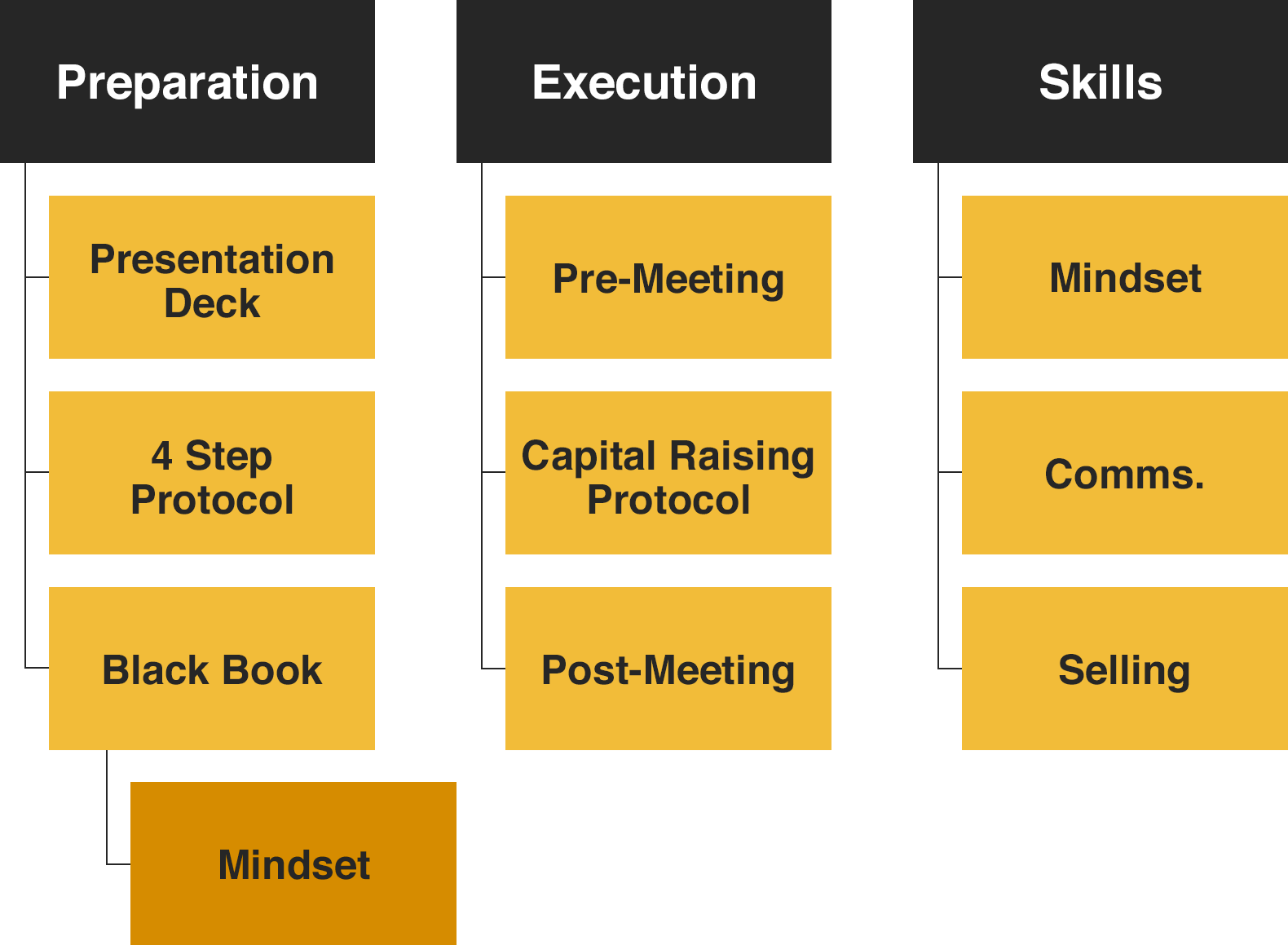

This is an end-to-end, highly systematic method for how you best prepare to crush your capital raise.

Building your processes and skills.

And showing up your best each and every time to deliver top performance in every meeting.

For Raising Your Fund Bigger, Faster, Easier!

We crush these three things:

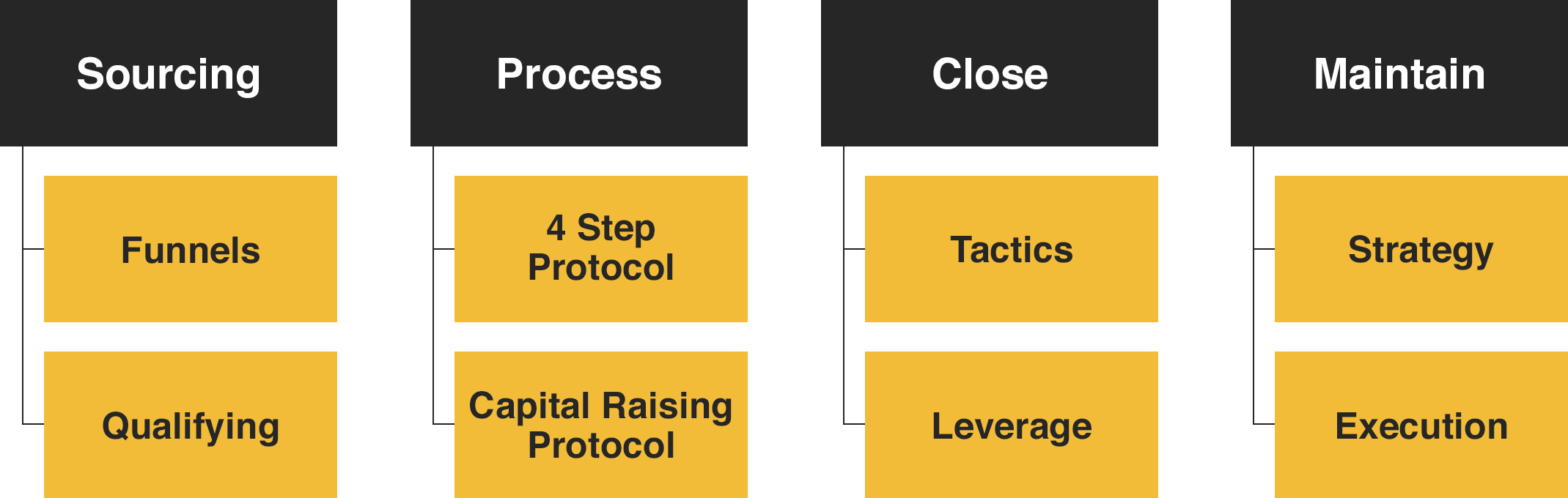

An end-to-end method.

From the way you target and qualify leads all the way through to the way you position yourself and your firm to drive your sale.Not just about the capital raise.

It’s about preparing yourself to show up your best each and every time driving top performance in every meeting.A way to get good at this, FAST.

Time waits for no fund. You want a highly sophisticated method that’s simple for you to learn fast and put to work right away.

Masterclass

Raise Your Fund Bigger, Faster, Easier

Discover the proven system for crushing your capital raise.

Here’s just some of what you get with this 16 hour masterclass.

- Raise Your Fund Bigger, Faster, Easier.

What are the mistakes? What does it take? How are we doing this together? - The System For Capital Raising.

We review the System For Capital Raising and the Macro Process for building your Capital Machine. - Principles of Capital Raising.

Because many of us have never studied selling, we’re not clear on exactly what sells, and how, specifically, you help investors buy. - Lead Generating.

Targeting the right investors is crucial to raising your fund bigger, faster, easier. We go deep into sourcing funnels and qualifying your best investors.

- The Four Step Protocol.

You see this in many of my programs. How do you show up like a pro athlete game ready for crushing the capital raise? - The Black Book.

We go deep into your Black Book for how, specifically, you crush the capital raise. We also include a 30 page Black Book template. - The Capital Raising Protocol.

Rather than boringly reading through a deck, you want a protocol to drive every meeting from your intent to next steps. - Deep Learning Track.

We bring together the Masterclass, integrating Raising Your Fund Bigger, Faster, Easier deep in your brain.

Track One

Introducing Raising Your Fund Bigger, Faster, Easier.

The MASSIVE hidden problem.

For some investors is…

They don’t know what their business is!

- The business isn’t investing. It’s capital.

- This becomes obvious to investors once they’re in business. First they call it a fund, but soon see, actually it’s a business that manages funds.

- They’re no longer just an investor. They are founders of a business that raises, deploys and maintains capital.

Presenting isn’t selling.

Punching someone isn’t shooting them.

And “presenting” isn’t selling anyone anything.

In our society skills of communications are diminished as “soft-skills” but what’s more hard-core than skills that have gotten the last two presidents elected?

- Some investors think that because they can speak eloquently they are skilled at capital raising, but in one question you can expose their amateur game…

- “What, specifically, is your process for destroying an objection?”

- Most certainly if you lack a way to destroy objections, you lack a process for selling.

The capital raise is preparation.

The craft of selling is not what most of us think.

It’s natural to think selling is what you do when you have a prospect in front of you.

But that’s only the tail end.

- Like pulling a trigger is the end of the process of firing a gun, most of the sale happens way before you’re sitting with an investor.

- More than convincing someone to invest, raising capital is everything you do in preparing yourself to get in front of hungry investors and help them buy.

This requires different processes and skills.

As I wrote in my book on Trump, the processes and skills required to win an election are very different to those of governing.

The same is true of investors.

- The processes and skills required to be a top investor are very different to those of being a top capital raiser.

- Investors have spent often decades mastering their craft of investing, but how many have even trained, let alone dedicated themselves to mastering the capital raise?

Three bigger, faster, easier topics.

There are three big topics we work through in this Masterclass for Raising Your Fund Bigger, Faster, Easier.

- 1. Positioning your firm: This isn’t about walking through a deck. How do you best position your firm like a pro?

- 2. Knowing what actually sells: Why do investors buy? How do you lead them through the buying decision?

- 3. Who must you be? To best position your firm and drive your sale, which “version” of you must show up?

Track Two

The System For Capital Raising.

Even the best ideas are not enough.

All of my work is highly systematic because that’s what you want.

Systems drive your best process, results, and give you a powerful method for continuously improving.

- People hear the word system and it can sound fancy, but in the end all that matters is how good you can get at consistently, repeatedly putting them to work.

- So it must be simple.

- Like an auto production line. There’s a lot that goes into putting a car together, but laid out on a production line it’s just a series of small steps.

Too many incomplete solutions.

In life we come across many basic and incomplete solutions.

If you’re hunting for a job people say you just have to get out there. You have to network. OK. With whom? Where? When? How?

It’s a decent sounding idea but it’s weak.

- Raising your fund is much the same. People say you need to increase your pipeline. Get more names in the top of the funnel.

- Great. It sounds smart, but how? What is your specific method?

Consistent, repeatable, end-to-end method.

A key to all success is highly consistent, repeatable processes that you put to work over and over again, continuously improving.

If you’re deep into my work you see these systematic approaches to everything—e.g. My System For Winning, System For Your Limitless Mind—and The System For Capital Raising is much the same.

- This system is far beyond random ideas on how you walk into a meeting and tell your story to walk out with the order.

- End-to-end, how do you target your hungry buyers and best prepare and execute to help them invest?

The System For Capital Raising has 3 pillars.

- Preparation is how you show up your absolute best each and every time. Not just showing up to flick a deck, but to drive your sale like a pro athlete on Game Day.

- Flawless execution too comes through flawless preparation, which comes back to knowing exactly how you move a meeting forward using the Capital Raising Protocol.

- Winning takes skills. We don’t explicitly cover these Power Skills in this program but give you bonus tracks for quickly building winning skills.

Why settle for one crushing system?

In this track we also introduce The Macro Process which is a systematic method for how you, specifically, go to market for Raising Your Fund Bigger, Faster, Easier.

We go deeper into this method in the subsequent tracks.

- How do you systematically spin up your sourcing funnels and qualify leads?

- Drive your process all the way through to investing?

- Coz, that’s what matters right? Which is why we discuss how closing tactics and leverage are built into every step of the Capital Raising System.

- The final pillar, Maintain, we don’t cover in this program, other than to briefly discuss its role in your Capital Machine.

Track Three

Principles Of Capital Raising

To Raise Your Fund Better, Faster, Easier, master the principles.

Everything I do is systematic and principles-based. Why? Because it is by far the best and fastest way to master anything!

Don’t just take it from me…

- Ray Dalio’s made billions of dollars off his principles because as he puts it, “Principles are concepts that can be applied over and over again in similar circumstances as distinct from narrow answers to specific questions.”

- Yet, when it comes to most things in life, including capital raising, nobody teaches us the principles.

Nobody teaches us selling, let alone the principles that drive it.

Given selling has a tainted name, many want to avoid labeling capital raising this way.

But seeing it as selling makes it clear what this is and advantages you to access the endless knowledge around how we buy.

- What actually leads people to buy, or in our context here, invest?

- Think about the average capital raising meeting. What are they selling?

- More or less, many managers are trying to sell only selling one thing… We are smart.

- Even then, “And we’ll make you money” is often left out.

Smart is mastering the principles of selling!

See, the problem here is that although we’re constantly sold to, nobody ever teaches us what sells, or why we buy.

Just like in school, or Harvard Business School, we learn what matters is sounding smart.

- A professional never sells that way.

- They recognize that no matter what words are used on the surface, it’s what’s happening at a deeper level that leads us to buy.

- The point I’m making is there’s a predictable and usable process of selling that advertisers, salespeople and influencers use all the time.

- These are the principles of selling, or in our case the Principles of Capital Raising.

The Principles of Capital Raising.

In my research I concluded that with just five principles you can master anything, which is why here we are covering six principles!

The sixth principle is a meta principle, which means, arguably, with just this one principle you could drive the other five.

- Principle 1 is simple, but few will ever do it… Selling is preparation.

- Principle 2 is what you’re preparing… Process and skills.

- Principle 3 is knowing it’s not about you or your firm… It’s about them!

- Principle 4 is knowing why we buy… One word… Emotion.

- Principle 5 is knowing, specifically, how do you Navigate Them Buying?

Track Four

Lead Generating.

Biggest mistake on selling.

The obvious thinking on selling, and here, capital raising, is that your job is to sit in front of people and convince them to invest.

This leaves managers trying to sell everyone, when the secret to selling and capital raising is…

It’s not about “selling.”

- First and foremost, selling is a sourcing problem.

- It’s about hunting down those people who don’t need to be sold to!

- Meaning, before you’re trying to get anyone to invest, you’re focused on, who, specifically, wants what you have, and how do you get in front of them?

- This is the essence of lead generating or sourcing.

Question: If you had a hot dog stand what advantages would you want on your side?

Best hot dogs? Bread? Location, location, location?

You can have all that. We’d want just one advantage… A long line of hungry customers.

- If you were fishing, you’d throw out a bloody great net and allow the right fish to swim to you.

- But you’re not fishing and you don’t have a net!

- And you can waste an enormous amount of time selling to the wrong investors who will never buy.

Your enemy is time.

The most precious resource in life and capital raising is time.

How much time do you want to spend on the road meeting with investors who will never invest in you?

- Politicians kiss a lot of babies to get votes, but if you’re sensitive to wasting years of your life you want to hone in on your most attractive prospects.

- It’s like an auto car salesperson. The first question they ask is, “When are you looking to buy?”

- They want to avoid wasting time with people who are just kicking tires to hone in on that hungry buyer.

Other enemy is poor preparation!

How many high quality leads can you afford to waste?

- Your target universe of potential investors and certainly highly qualified leads can be very small. This means you want to treat every lead like it is gold.

- You likely know that in the history of the world the amount of gold that has been refined is only enough to fill 2 Olympic size swimming pools.

- It’s rare. And so too is every lead. You might have to dig a lot of ore to get to the golden leads.

- So as we’re doing in this program, with each one, you want to show up ready to crush your capital raise.

Cap intro partners are ONLY the starting point.

Even if you work with a big capital intro partner like UBS, their job isn’t to put you in front of qualified leads, but to give you a lot of volume.

And although they’re incented to get your fund raised they do nothing training you how to best do it.

- It’s like two PE funds we worked with. They were as much twins as Arnie and DeVito, yet their capital intro partner, gave them the exact same list.

- That’s their job, and it can cost you years of your life, running around meeting with people who will never buy.

- Which is why you want to become highly skilled at spinning up and qualifying the right leads.

Optimize funnels and qualifying.

What are the best qualified sales funnels for you?

How do you organize them? Be systematic about getting them flowing? And spinning into vortexes?

- We go through 7 types of funnels, in helping you define what funnels are right for you.

- And 5 types of qualifying filters to keep honing in on those right leads for using your time most efficiently and effectively.

Track Five

The Four Step Protocol.

Showing up pro.

This track, a previous version of me walks you through The Four Step Protocol from the Winning Every Meeting Masterclass.

- The Four Step Protocol you see in a number of my programs where it counts for you to show up like an absolute pro.

- Game ready to drive your top performance comes down to the way you prepare your mind and tools to crush your game.

15 years of researching personal development in one simple tool.

Knowledge is impotent.

Winning isn’t about knowing what to do.

- It’s having powerful routines, processes, protocols, to consistently, repeatedly put to work the best of what you do.

- Just like a pro athlete on Game Day, this is what the Four Step Protocol is built for you to do.

- It’s about showing up your absolute best, prepared to deliver your best performance.

- From tens of thousands of hours researching top performance I built the Four Step Protocol to bring together four of the most important aspects of top performance into one simple tool you can easily and powerfully use.

Start with clear intent.

We all know goals are crucial to top performance, but how often do we have them, let alone keep driving them deep into our brains?

- Ahead of every meeting, know, why are you here?

- What results are you seeking? How are you getting here driving top performance?

What Character are you being?

Every pro knows who you show up as defines the results that are possible for you.

- Which version of you best shows up for crushing the capital raise?

- How do you model this Character? And condition yourself for showing up your best each and every time?

What’s your state?

Top athletes are maniacal about getting in a peak performance state for playing their best game, and top capital raisers are too.

- The world of personal development is full of talk on state…

- Yet what specifically are your peak performance states and your processes for igniting them?

- What is your state of body? State of mind? And how do you tap the elusive, flow state?

Winning takes tools and skills.

It’s one thing to have read some books on selling and influence and think you have a good grasp on capital raising…

- It’s another to be highly skilled.

- And it’s another thing altogether to bake into your Four Step Protocol your best tools and skills for annihilating the capital raise.

Track Six

The Black Book.

Show up your best prepared.

Managers spend a lot of time preparing their decks, and then even more time in meetings boringly reading bullet points.

They think a lot about what they want to say, but often too little on what investors need to hear to invest.

Let alone, who they must be in their meetings to best drive the capital raise.

Many investment professionals approach the capital raise like amateurs, when…

The Black Book is for pros.

The notion of the Black Book comes from the world of selling where top salespeople compile their best intel on the sale.

Constantly they are positioning their product for customers. Selling key benefits. Clearing common objections. Telling their favorite selling stories.

So instead of making it up each time, they compile their best ideas in their Black Book they use for every sale.

- The Black Book works the same in capital raising.

- Like your study notes for an exam, it’s where you capture all of your best ideas.

- Like the play book for a sports team, it’s where you lay out your best plays, how you’re best driving your sale each and every time.

- So you can review it over and over, practice over and over, for crushing the capital raise.

Use your Black Book to drive the sale.

Many prepare a deck and perceive their job is to read bullet points or write some notes in the margins to hit every page.

Our managers aren’t focused on the deck at all, but bringing their sale to life by capturing their best ideas in the Black Book.

They never rely on the deck to drive the capital raise but are constantly improving the way they drive the sale by continuously improving the way they show up, tell their story, and drive meetings from beginning to end.

3 things your Black Book does for you.

There are three specific things the Black Book is set up to do for you:

- 1. How you tell your story, position yourself and your firm.

- 2. The second section of the Black book is capturing your best ideas on the sale. What leads them to buy? What are the most common needs, wants? Emotional drivers, logical drivers, objections, etc.

- 3. The third thing we cover is the what comes first… YOU. This notion of Starting With You is, just like the Four Step Protocol, all about who you are best showing up as for crushing your capital raising meetings.

BONUS: You get the Black Book.

We don’t just talk about the Black Book in theory.

Included with this Masterclass is a template for your Black Book, which is some 30 pages we walk through in this track.

EXTREME WARNING!

Now I want to say…

It’s pretty extreme for us to share with you a Black Book for crushing the capital raise.

Not just extreme in actually having a Black Book…

But we’ve gone to this extreme of giving you the Black Book because we want to deliver you the absolute best of what you need to Raise Your Fund Bigger, Faster, Easier!

Track Seven

The Capital Raising Protocol.

“Do you invest in first time funds?”

That’s one of the first questions we train first time capital raisers to ask potential investors.

Why?

Because, how often does a manager get to the end of the meeting, or even weeks later, hear back from their cap intro partner…

- We don’t do first time funds!

- It’s the most bogus objection / rejection, the equivalent of—It’s not you, it’s me!

- And by asking this question right up front, you are either getting them more committed, or you’re learning right away, they are a waste of your time.

I share this nugget to highlight a theme of the Capital Raising Protocol.

That you are stepping into a meeting to figure out if they are a qualified lead for you…

And if so, to keep moving them towards your next step.

- In selling it is said, the only thing better than a quick yes is a quick no.

- And throughout the meeting you’re constantly figuring out whether they are right for you to keep investing more time with, or to GTFO.

A protocol for driving your meetings.

More generally…

It’s one thing to show up your best prepared, and another to show up best prepared for driving a meeting from beginning to end.

- The Four Step Protocol enables you to prepare like a pro athlete stepping into the arena game ready, and the Capital Raising Protocol is for driving top performance once you’re inside.

- All sports teams have plays. Chess grandmasters know their opening, middle and closing moves.

- The Capital Raising Protocol is for making your best moves, driving the meeting from open to close.

- In this track we review each step and cover 3 powerful tools of influence, framing, and conveying a point for each step.

This matters because…

A common mistake we make in meetings is we can get focused on what we’re talking about (the content) and pay too little attention to the overall “structure” of the conversation.

This means we can get to the end of the meeting and fail to address those things that most matter.

How often do capital raisers spend tons of time talking about topics of little significance to get to the end of the meeting without having figured out what actually matters to driving the sale, let alone, actually hooking their potential investors?

- What matters? What must you do in the meeting?

- It’s like baking a cake. You must know what goes in, and often in the right sequence.

Making your right opening moves.

What does it mean to pre-frame?

We all know what it means to build rapport. But, how, specifically, do you walk into a room and deliberately, rapidly, build rapport?

Then, what do you do with it?

Stop talking and discover…

The biggest mistake many capital raisers make in meetings is they walk in and start talking.

It’s not just that they too often boringly, monotonously read boring pages from boring decks…

It’s that as long as you’re talking you fail to get that investor talking.

- Sharing with you their needs. Their pain. What leads them to invest, what doesn’t, etc.

- Ultimately, everything they need from you to be of value to them!

Benefits and Objections are the core of selling.

We talk about them as Drivers and Roadblocks.

Because here in this Capital Raising Protocol you’re discovering what drives investors forward and what gets in their way.

- Every salesperson knows selling is about benefits, but how, specifically, do you frame up your benefits?

- What about your objections?

- And how do you best lay them out in your Black Book?

- Many people kid themselves that they know the craft of selling but if you don’t know, specifically, how to blow out an objection, you don’t have a process to sell.

- Here we cover a simple, powerful two-step process you can be putting to work right away.

Driving to your Next Steps.

A mistake many salespeople and capital raisers make is that they fail to even know what is their desired next step…

- Let alone, how to get here.

- Or to hone in on, specifically, just locking in this step.

- Most meetings aren’t about getting to close, are they? You’re not expecting to walk out with the order, are you?

- Just to keep them moving to the next step in your process is your most powerful call to action.

Track Eight

Deep Learning Track.

As you know, the trick to great learning is for it to happen automatically, unconsciously, like driving a car, and this track works for you the same way.

In the previous tracks you’re doing a lot of work, listening to the tracks, doing the work in the Workbook and Black Book, bringing your systematic method together for Raising Your Fund Bigger, Faster, Easier…

And here in this track, you sit back, relax, and allow it to do all the work on you!

- Bringing it all together.

This track reviews the program in a way it becomes deeply integrated in your brain. - Not just a review.

This is a different type of learning experience many of us aren’t used to, one that quickly, deeply, gets the Capital Raising System ingrained in your mind. - For getting you crushing the capital raise.

Driving your best performance and results for Raising Your Fund Bigger, Faster, Easier!

What's This Program Worth To You?

Value of Raising Your Fund Bigger, Faster, Easier

Here’s some of the value you get from this 16 hour program for crushing the capital raise.

What ISN’T this worth to you?

- What’s the cost of failing at this?

- In the absolute worst case you go to market and fail to get your fund raised.

- In a less worse case you spend a lot more time raising a lot less capital, which now you’re committed to manage in a sub-scale platform.

- What’s the cost to your reputation? To your time with your family while on the road?

On the rosier side, what’s your upside here?

- A reason our capital raising clients pay us handsomely for these services is they know what this might be worth to them!

- In a hedge fund, what’s it worth to get that initial capital raised?

- In PE or VC, we all know that a successful first fund raise could be the starting point to bigger and bigger funds, a potentially enormous annuity stream.

- What might crushing the capital raise be worth to you?

Clients have raised billions of dollars using this method.

- We only work with a small number of clients looking to go big, fast!

- Two PE clients have raised a $600+ million and north of billion dollar first time funds using this method.

- Another client has built a high net worth wealth manager from scratch to a billion dollars, including training a salesforce in this method.

- What might be possible for you?

Get access to the method clients pay us 6 to 7 figures to learn.

- Until now this program has only been available exclusively to my private clients and clients of our consulting firm, BLK.

- Just like them you get an exclusive audience with me ranting and raving about crushing the capital raise in your ears!

- In a program you can listen to over and over again, anytime, anywhere you choose.

- At a fraction of the investment clients pay me for one hour of my time.

The best of what I’ve learned in my career.

- This Masterclass brings together all I’ve learned in my 20 year career on and advising Wall Street leaders, as well as that of my team.

- From my career at Goldman Sachs, advising clients on equity and debt capital raisings, as well as on the buy-side at The Carlyle Group.

- Bringing together some two decades, tens of thousands of hours research and development I’ve done on the hardcore topics of personal development and selling that go into this program.

- As well as the best ideas I’ve learned as an advisor to Wall Street leaders, including founders of firms raising capital.

An end-to-end system built by Wall Streeters for Wall Streeters.

- This Masterclass is far beyond some random ideas on “selling,” tailored for capital raising.

- An end-to-end custom method built for investment professionals by bankers and investment professionals.

- Starting with sourcing, how do you best source and qualify leads?

- To how you best prepare to walk into every capital raising meeting.

- And to absolute crush the capital raise while you’re in there!

A custom-built method that’s designed to work for YOU!

- This program brings together the best ideas I know into the best method I can imagine, yet it’s built to be tailored for your best ideas.

- This isn’t a bunch of ideas telling you how to capital raise, but a method you can adapt specifically for you.

- As Bruce Lee put it, “Adapt what is useful, reject what is useless, and add what is specifically your own.”

16 hours plus Workbook, Black Book and BLK Research Report.

- This is designed as a comprehensive program to bring all these ideas together for you.

- 16 hours of action packed audio.

- A Workbook and Black Book in document format you can easily fill in.

- Also included with this Masterclass is a BLK Research Report for Capital Raising Like You Invest… As A Pro!

BONUS: Wait there’s more 🙂

- To augment the Skills pillar of the System for Capital Raising we include two tracks for rapidly building skills.

- From the System For Winning Masterclass included is a track for rapidly Getting Skills.

- From the Winning Every Meeting Masterclass, included is a track for specifically building the 3 Power Skills—Communications, Selling and Mindset.

Not to labor the point, but… What ISN’T this worth to you?

- With all you put into starting your own firm and getting your fund raised.

- Everything you’ve done in your career to reach this point.

- Your reputation and everything else you’re putting on the line for this.

- And perhaps most of all, your most precious asset, time…

- What’s not value in Raising Your Fund Bigger, Faster, Easier?

Purchase Raising Your Fund Bigger, Faster, Easier today and get 30% off

$12,195.00$8,495.00

Secure checkout / 100% Unconditional Money-Back Guarantee.

![]()

This Is A Career Leap!

Might not seem it, but…

Hi, I’m Geoff Blades.

That’s why it’s hard for many managers to make this leap.

Not just to raising their first time fund, but starting their own firm.

They’ve never done this before.

In the past their job was only to invest, but now they’re required to wear many different hats.

Hiring a team. Managing people. Getting office space.

Getting the fund raised.

Many being great investors presume they can just put on all these hats.

Think they have these skills.

But how could they, having never done it before?

No top salesperson imagines they could be a top investor.

They recognize the job requires a different set of processes and skills.

Having never studied the craft, they’d never think they could just waltz into an investing seat.

Yet, many managers waltz into meetings thinking that’s all they need to raise their fund.

Which is why many fail to get their first fund raised, or at the size they want, let alone to stay in business long after.

It’s humbling, especially as a winner in the world, to admit what you don’t know.

But that’s exactly what winners do.

They recognize where they lack edge and seek ways to build it, fast.

Fortunately, you can learn this FAST.

A reason you can learn this fast is because…

Although capital raising requires a very different set of processes and skills to investing, there’s a huge overlap in the way you approach it.

Investors spend their lives analyzing company stories and here you’re perfecting your own.

Too, top investors are pros at the mental game, and running rigorous investment process.

Which has similarities to the three phases of the capital raising process—

- 1. Akin to idea generating or deal sourcing, lead generating is about filtering the world for your right opportunities.

- 2. Like an investing process, capital raising is a rigorous process you run end-to-end.

- 3. Investing takes skills, and so does capital raising!

Also you can learn this fast because…

That’s what this system is built to do.

You couldn’t teach someone to invest like a pro fast, and you can’t teach someone selling fast, either.

But what you can do…

Is bake the best ideas into a rigorous method that anyone can learn to powerfully put to work, fast.

As I keep saying, knowledge is impotent.

It’s not about what you know but being about to systematically, repeatedly, consistently put to work the best of what you do.

This is what this program for Raising Your Fund Bigger, Faster, Easier is proven to do.

Proven to work for you.

I know this method works because I’ve been putting elements of this to work for 20 years.

When I first stepped back from my career at Goldman Sachs and began focusing on how you crush your career in investment banking…

I began building this method for the banking sale.

Modeling other bankers and working on equity and debt offerings with clients, for years I honed these methods.

The same is true at Carlyle, where I did little fundraising, but saw many PMs desperately needed this!

On top, for now nearly 10 years working with clients, I’ve kept improving these methods.

Seeing this work over and over again.

And I expect the same for you!

Raising your fund can be hard.

Yet having seen it for myself and over and over again with clients…

I’m certain that if you dedicate yourself to deeply learning this program.

It will part of your winning method for Raising Your Fund Bigger, Faster, Easier!

Purchase Raising Your Fund Bigger, Faster, Easier today and get 30% off

$12,195.00$8,495.00

Secure checkout / 100% Unconditional Money-Back Guarantee.

![]()

STOPPP!!!

No time to waste.

A common theme we’ve seen with managers is by the time they come to us the clock is ticking.

They’ve left their job.

Are in the process of starting their own firm, gearing up for the capital raise.

They’ve done what they’re used to from their old job, pulling a decent deck together.

And then…

They’re struck with the enormity of the task.

It’s typically when they start talking to cap intro partners, and certainly investors they realize…

You’re not special anymore!

Not some big time investor sitting on someone else’s platform…

Where, the capital more less seems to raise itself.

Now, you’re just another startup fund, trying to get investors attention, to convince them why they should make a bet on you.

Even good friends told a HF manager we’re working with—

What are you doing?

In this market, why would you put your capital and reputation on the line to raise your fund?

It’s not to say all first time funds or existing managers face a challenge in capital raising.

But even successful capital raisers know…

No lead to waste.

The first thing we say to these managers is…

STOPPP!!!

Stop talking to people.

If you’re not certain on your story.

If you’re not highly skilled at the way you engage capital raising conversations, then stop.

Leads are too precious, and you have none to waste.

As we wrote above, leads are gold.

They are hard to dig up, especially qualified leads, which can still be hard to engage and convert to orders.

You only get one shot to make a first impression.

And especially in the highly competitive business that is asset management, each and every time you want to show up your absolute best.

How many shots do you get?

How many high quality leads do you expect to source?

Even if you’re using a big cap intro partner like UBS you might get hundreds of meetings, but how many are real legit leads?

What about if you’re a startup hedge fund, especially in this tough market.

How many seeds might you meet?

How many hungry buyers of hedge fund product?

Like an Olympic athlete where one heat determines their future…

Just one lead can make your fund, and you want to show up to optimize your performance at every meet.

As we said, ultimately, selling isn’t about “selling!”

It’s a search process, hunting down those investors who are right for you, and when you meet them, you must show up game ready.

So time is working against you.

And us nearly every time, when managers come to see us they are already prepping to go to market, so you must be able to get highly skilled at this fast.

Fortunately, we’ve built the solution…

For Raising Your Fund Bigger, Faster, Easier!